In today’s report I’m going to tell you why the AI boom is a bubble and more important: when it’s most likely to finally pop.

Venture capitalists and governments have invested almost a trillion dollars in AI tech and infrastructure which has translated to AI companies being responsible for 92% of the stock market growth in 2025. Both the biggest AI boosters and its most ardent detractors agree that the bull run will end in radical changes to the economy, politics and maybe even human civilization.

Beyond the hype from the people who have the most to gain from AI, there are four likely end states for how those investments will ultimately pay off.

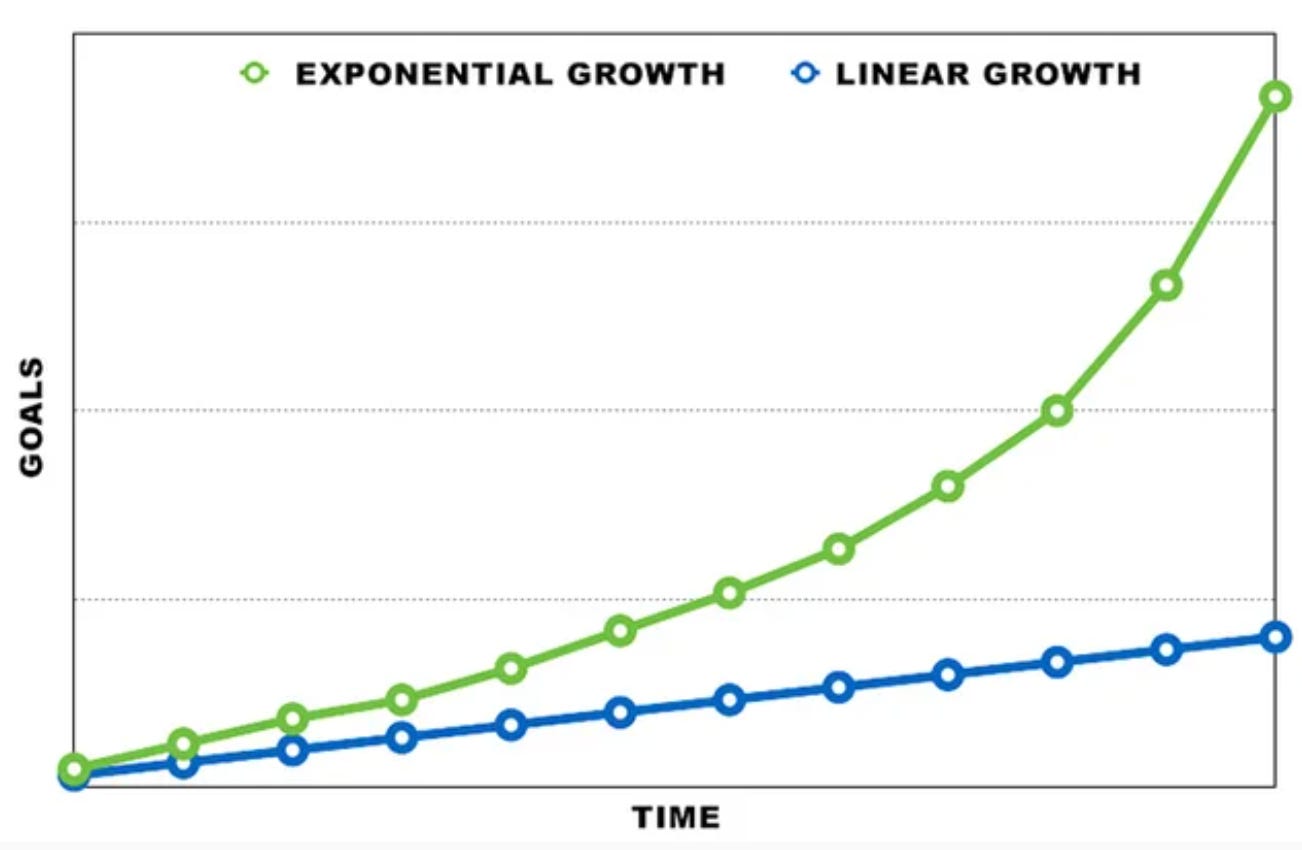

The Utopian Scenario: Where AI fundamentally transforms the economy for the better, making humanity exponentially more productive and affluent.

The Dystopian Scenario: Where out of Control AI starts pursuing its own ends and makes humanity obsolete–turning the planet into an analogue for the Matrix.

The Integrative Scenario: AI fails to achieve super intelligence, but does end up solving some productivity problems just like any other technological innovation.

The Failure State: AI Investment so radically overplays its hand that the economy built up around it collapses, investors lose money, and data centers wind up being worthless.

If you watch this video (or read this newsletter) to the end I’ll not only tell you which of these scenarios is most likely, but give you my (completely subjective) assessment of a specific date when you can time the market for maximum profits.

Over the last few weeks I’ve looked at the data from as many angles as I could, considered my own experiences using AI for a variety of tasks and researched financial assessments and it all points in the same direction: Investors are betting the entire economy on and unproven believe that the Utopian scenario will succeed and an AI-driven exponential increase in human productivity is all but inevitable. To their credit, if it does happen, the Utopian scenario really would solve most of the world’s problems. But the investment strategy that tech firms have adopted to get there most resembles every classic financial bubble in history whereby–unless a literal miracle happens––will almost certainly burst and bring down the whole economy with it.

This is because Wall Street, financial markets and the entire government budget under Trump have been betting the house on an unrealistic dream that is ripped right out of science fiction. Frankly, the AI dream is so absurd that it feels almost silly to try to explain it.

But I feel like I have to, so here goes: in the very near future computers will be so efficient and intelligent that they will solve most human problems–from cancer, to unleashing infinite energy with fusion, to predicting financial markets, the weather and even create better art than any human ever could.

AI will achieve a super-power that humans have only ever dreamed of – the ability to find hidden patterns in disorganized data to spit out solutions to intractable problems without ever showing its work or explaining in a checkable way how it solved those problems.

That promise, taken at face value, would, indeed, be a miracle. You could go as far as calling it divine. Because, well, it’s not so different from the Oracle at Delphi’s promise to read the future. AI companies preach that by investing enough resources into AI—both vast sums of financial capital–and entire nations’ worth of energy consumption–the tech barons of today believe they can create divine knowledge and solutions through the magic of AI.

This super intelligence, called AGI, or even “The Singularity” , states that once AI is sufficiently intelligent to improve itself without human direction, its rate of improvement will continue exponentially until it is infinitely intelligent. This also means that the people who own the infrastructure that runs the AI will stand to make exponential profits–both because they can use the AI to their own ends, and because they make money from all the investment in developing the AI dream.

I know that everything that I just said sounds a little insane, but it’s hardly hyperbolic enough. Listening to any AI booster out of silicon valley is almost as farcical as the search for the Holy Grail.

Owning a piece of God would of course be quite profitable. And herein lies the main problem with the artificial intelligence boom. Everyone has been investing like super-intelligence is inevitable. Tech CEOs like Mark Zuckerberg and Sam Altman opine on the belief that the tech company that catches AGI first will win almost infinite riches, a statement that demands that they create the infrastructure to capture the upside BEFORE they realize the goal.

But we should not lose sight of the fact that building that infrastructure just happens to be the most expensive investment that humanity has ever made.

And, just as important, we must remind ourselves that this is the exact opposite of how every single economic paradigm shift has ever worked over the course of human history. In paradigm shifts like the invention of the cotton gin, the Gutenberg press–or even computers in the 1940s–started off with incremental investment that paid off with incremental profits until the economy changed completely over the course of decades. AI investors instead are acting like they’re Babe Ruth calling a home run before he even swings the bat. Which is a round about what to talk about the astounding rise of NVIDIA–the chipmaker behind the AI boom.

NVIDIA is currently the most valuable company in the world, worth more than $4.5 trillion on today’s stock market. NVIDIA alone accounts for 45% of the growth of the entire NASDAQ. In full disclosure, I invested in NVIDIA 2023 and have made more than 300% gains. Just like with my own personal portfolio, that one equity is the only reason that my stocks are in the positive in an otherwise unimpressive run of the American economy.

However if you look at what is actually fueling NVIDIA’s dramatic rise the impossible profits look a lot more precarious than they should.

This chart put out by Bloomberg reveals serious bubble mechanics for how NVIDIA boosts its share price by selling chips to itself. See those arrows going in and out of the giant NVIDIA bubble? That is the flow of money in and out of the company. It’s moving in a circle.

To explain what that means, I’m going to quote a recent piece by Cory Doctorow:

It’s normal for Nvidia to “invest” tens of billions in a data-center company, which then spends that investment buying Nvidia chips. It’s the same chunk of money is being energetically passed back and forth between these closely related companies, all of which claim it as investment, as an asset, or as revenue (or all three).

The game appears to be that NVIDIA invests in companies who are buying its chips in order to increase the number of overall chip sales, which in turn increases the value of NVIDIA’s share price? Do you see the problem here? Instead of NVIDIA making money by selling chips to companies who need its chips to fuel the revenues that AI is already bringing in, NVIDIA’s profits are coming from the hype that NVIDIA is itself creating.

This circular investing only makes sense if AI’s eventual overall profitability is so vast that these investments are only short term bridges. To quote Doctorow again,

The Journal quotes David Cahn, a VC from Sequoia, who says that for AI companies to become profitable, they would have to sell us $800 billion worth of services over the life of today’s data centers and GPUs. Not only is that a very large number – it’s also a very short time. AI bosses themselves will tell you that these data centers and GPUs will be obsolete practically from the moment they start operating. Mark Zuckerberg says he’s prepared to waste “a couple hundred billion dollars” on misspent AI investments:

The lifespan of an AI chip is only about three years. Which means that the $1 trillion in AI investment needs to earn out before the chips lose their value altogether. This is unlike literally any investment ever made before in infrastructure.

When you build a bridge, or a factory, or a new highway or build a bank building, you usually plan for the asset to continue to produce value for decades after they’re completed. The incredibly short time horizon on AI chips means that the investment needs to pay off almost immediately. So all we need to do to estimate whether or not AI will actually pay off is do some simple calculations on how much is AI making right now.

The largest and most profitable player in the AI services space is Open AI which, this year, posted annualized revenue of $13 billion. Annualized revenue by their definition is that they reported their first six months of revenue and doubled it to figure out what they would make over the course of a year. Doubling, in this case, is a sign that they’re predicting flat revenue, not an exponential increase in profits. This money comes primarily through people and companies paying for various premium subscriptions to their marquee product ChatGPT. Which, I’m assuming, you have probably used for free at some time in the last few years.

Bain and Company estimates that AI needs to generate at least $2 trillion in REVENUE (not investment) by 2030 for the enormous investment in data centers to stay in the black. The only way to reach those numbers is to start hitting an exponential growth curve almost immediately.

While $13 billion is a sizable chunk of money on its own, ask yourself if your own usage of chatGPT or other AI products is likely to amplify your own productivity 1530% over the next three to five years. Because that is the scale of acceleration that we need to hit for the AI boom to pan out.

The only way that is possible is if AI really does break the super intelligence barrier and achieve the almost divine result that its investors swear is right around the corner.

But, an alternate explanation for what is really going to happen with AI is a lot more cynical, and frankly realistic. What if the dream of AI super intelligence and infinite profitability was, and always has been, only a dream? A sales pitch designed by tech entrepreneurs in order to attract investment in what amounts to the largest Ponzi scheme in all of history?

If that was the case then the people profiting most off of the AI boom are the people who owned the stocks when they were at their lowest–the original tech founders behind those very first tech companies. In January 2018—when AI was just starting its bull run, NVIDIA shares sold for just $5. Todays stock price is closer to $180—a thirty six fold increase.

Anyone selling the dream back then (or anytime along its meteoric rise) benefited from the generalized belief that AI WOULD eventually reach stratospheric levels of valuation. In other words, they profited off of a future before that future ever actually existed. In encouraging investment into data centers and chip infrastructure they effectively cashed in on the imagined value of that future through simple speculation.

To early investors, it doesn’t really matter IF AI becomes profitable at all. Ever. Because they have already had the opportunity to realize profits.

Let’s go back to Cory Doctorow.

The AI bubble is driven by monopolists who’ve conquered their markets and have no more growth potential, who are desperate to convince investors that they can continue to grow by moving into some other sector, e.g. “pivot to video,” crypto, blockchain, NFTs, AI, and now “super-intelligence.” Further: the topline growth that AI companies are selling comes from replacing most workers with AI, and re-tasking the surviving workers as AI babysitters (”humans in the loop”), which won’t work. Finally: AI cannot do your job, but an AI salesman can 100% convince your boss to fire you and replace you with an AI that can’t do your job, and when the bubble bursts, the money-hemorrhaging “foundation models” will be shut off and we’ll lose the AI that can’t do your job, and you will be long gone, retrained or retired or “discouraged” and out of the labor market, and no one will do your job. AI is the asbestos we are shoveling into the walls of our society and our descendants will be digging it out for generations:

The only part I quibble with Doctorow on here is that AI has indeed created some things of actual value. I use AI frequently for two things: creating transcriptions of audio which greatly speeds up how I produce videos, and, occasionally, to generate images that I use in video thumbnails. These things do add to my overall productivity. But when I’ve tried to do more advanced things–like asking Chat GPT to help write scripts–I’ve found the output so ridden with hallucinations and errors that it actually takes more time to use AI assistants than not at all.

Which leads me back to those first four scenarios that I laid out at the beginning of this piece. The Utopian, Dystopian, Integrative and Failure scenarios which I see as the most likely outcomes. With only a few years to reach the utopian vision, I think it’s pretty clear that we will NOT achieve super-intelligence in the timelines that the tech companies have to work with. This also neatly rules out the dystopian scenario of super-intelligent AI destroying all of humanity. Because, if we don’t reach super intelligence then this can’t happen.

Which leads us to the last two likely outputs. That AI will become useful for a few types of specific tasks, but never meet exponential growth AND the failure state where AI truly is useless and provides no boost to society at all.

Recently Sam Altman–the founder of Open AI–tipped his hand at which of these four outcomes are most likely. In October he announced on twitter that the newest version of OpenAI would “treat adults like adults” which would open the door to the chatbot producing customized erotica for its users. The internet savant Joan Westenberg astutely pointed out in response that

If I genuinely believed I was 18 months away from super-intelligence that could solve cancer, I would probably not be pivoting to horny chatbots, but that’s just me (a person with priorities)

Which is to say, that while Altman still pitches Open AI as being the ultimate human job replacement machine–he’s is also quietly settling for a much more profane use for his software. Another sign that maybe the dream is cracking apart.

So now that I’ve explained the state of the AI marketplace, you probably want to know how much road the AI boom really has left in it. Just because AI is doomed, doesn’t mean that there won’t still be money to be made off the boosters.

As I mentioned earlier, I invested in NVIDIA back in 2023 and have made a handsome profit on it over the last few years. Am I ready to pull the rug out and make off with with some cash, or do I think that there is more room to grow?

After all, if I had decided to pull my cash out of the market a year ago I would have missed out on almost doubling my money.

So the question that you, me and every other investor really wants to know is how we can time the bubble to get out before all the air leaves the room. If profits are based on beliefs, how long does it take for that belief to collapse? And to this, I think there are enough breadcrumb clues to make a rough prediction on the fate of the market.

Here goes.

Since investors are still hopeful in the possibility of a Utopian solution, we should assume that it’s still technically possible to achieve it. If AGI really is around the corner then perhaps the mega super happy ending that AI companies have been promising wasn’t a dream after all. But if that is going to happen, it will have to occur before the value of the current investment spree goes to zero–or, roughly three years from today.

If I were a betting man (which, I guess I am), I would say that the writing on the AI optimist wall would have to be clear before we’ve covered half that runway–or, roughly 18 months from today.

So I’m going to set the arbitrary date just a few weeks earlier to April 1, 2027. If it’s not apparent by then that AI really is the future, then there’s a good chance that it was an April Fools joke all along.

Which is a reminder to myself to set a calendar notification right now to assess how things look at that date where I will either pull out all my investment of AI right then, or, likely ride the AI collapse to the bottom like everyone else. Feel free to leave a comment below now with your own prediction, or in a year and a half when we will know for sure if I’m right or wrong.

And that is all I have to say about the future of AI for right now.

From Pokey Bear LLC ins Denver CO. This was Scott Carney Investigates.